By Chantelle Gladwin-Wood (Partner),

Charissa Paige-Green (Kok) (Partner),

and Karabo Kupa (Candidate Attorney)

13 November 2025

By Chantelle Gladwin-Wood (Partner),

Charissa Paige-Green (Kok) (Partner),

and Karabo Kupa (Candidate Attorney)

13 November 2025

INTRODUCTION

The City of Tshwane (“COT”) Municipality has given notice in terms of Section 49(1)(a)(i) of the Local Government: Municipal Property Rates Act 6 of 2004 that the Supplementary 5 Valuation Roll (“2021 Supplementary 5”) is open for public inspection and comment from 08 October 2025. It will remain open for inspection and objection until 21 November 2025.

WHAT IS A VALUATION ROLL?

A valuation roll is a database in which the COT stores the municipal valuations and categorisations of all properties in the municipality. Every property in Tshwane should (in theory) appear on a general roll. However, because properties are continuously being created or removed, supplementary rolls are issued to capture properties that were not included in a previous general roll.

Each general valuation roll is republished every few years (usually every 4 to 5 years in Tshwane), and property values and categorisations are updated at that time. Depending on various factors, your property value may have remained the same, increased, or decreased compared to the value listed on the previous roll. The information on the valuation roll is used to calculate your monthly rates and taxes.

WHERE CAN I FIND THE ROLL?

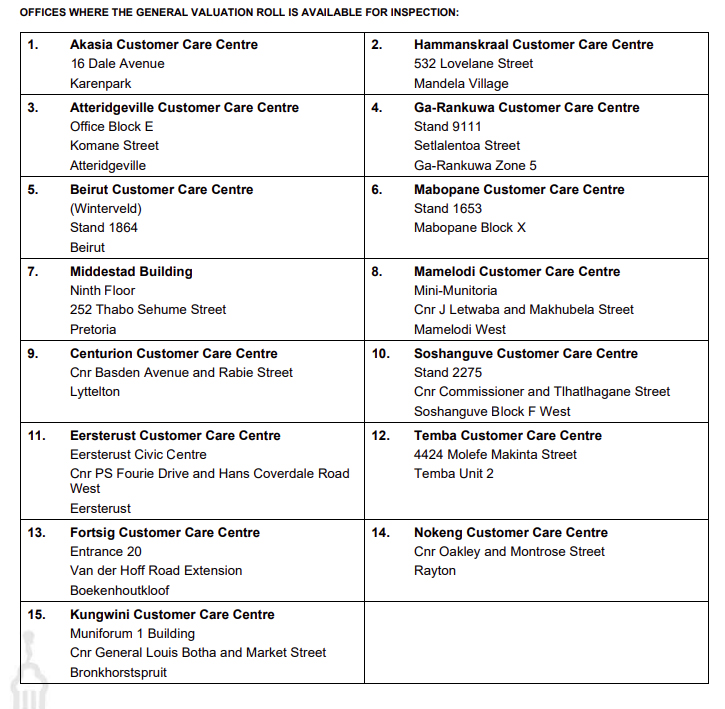

To search for your property on the roll, visit the COT’s website: https://propertyvaluations.tshwane.gov.za/. The prescribed forms for lodging an objection are available on the COT’s website. According to the notice, these forms are also available at COT offices at the following addresses:

WHAT IS THE EFFECT OF THESE DETAILS ON THE ROLL?

If you expected or wanted your property to appear on the roll but it is not listed, you must file an “omission objection” through the normal objection procedure.

WHAT HAPPENS IF YOU DO NOT CHECK THE ROLL?

It is the responsibility of every property owner to check the municipal property valuation and categorisation assigned to their property. If the municipal valuation does not reflect the true market value, or if the categorisation is incorrect, you must submit an objection before the end of the objection period. Failure to do so may result in the ascribed value and categorisation remaining in effect for the last year of the 2021 General Valuation Roll period.

WHAT IF I AM NOT SATISFIED WITH MY PROPERTY DETAILS AS THEY APPEAR ON THE ROLL?

You must file an official objection between 08 October 2025 and 21 November 2025. The final deadline is 21 November 2025 at 12:00. If you miss this window, there are alternative ways to address the situation, but they may take longer and cost more. DON’T MISS THE DEADLINE. ENSURE YOUR OBJECTION IS COMPLETE AND SUBMITTED PROPERLY.

WHAT IMPACT WILL ANY CHANGE TO MY PROPERTY DETAILS ON THIS ROLL HAVE ON MY RATES CHARGES?

The market value and category assigned to your property on the 2021 Supplementary 5 Roll will determine how your property rates are calculated under the COT’s 2025/2026 Property Rates Policy, which came into effect on 1 July 2025.

The category determines the tariff to be applied, and the market value determines the amount on which that tariff is applied.

WHAT KIND OF VALUATION EVIDENCE DO I NEED TO INCLUDE IN MY OBJECTION?

There is evidence that a property owner can submit to support their objection. Kindly find the link below to our article on Evidence Supporting Municipal Valuation Objectives for more information: https://hbgschindlers.com/evidence-supporting-municipal-valuation-objectives/.

FURTHER INFORMATION ON HOW PROPERTY ROLLS WORK

If you need more information on how Property Rolls work and how they can affect your municipal property rates, kindly find a link to further resources below:

OBJECTION FORMS AND PROPERTY RATES POLICY

To access the necessary objection forms and the COT Property Rates Policy, kindly find the link the COT’s website, on which they can accessed:

https://propertyvaluations.tshwane.gov.za/default

NEED FURTHER ASSISTANCE?

HGBSchindlers Attorneys and Notaries can assist, but we do charge for our services. Email public@hbgschindlers.com for more information or if you require assistance with your objection.